National Journal: JA Finance Parks Improving Financial Literacy

Author: JA of Greater Washington

Financial Literacy

Published:

Friday, 04 Dec 2015

Sharing

Junior Achievement Finance Park: Playing with Money

.jpeg/400w/50q)

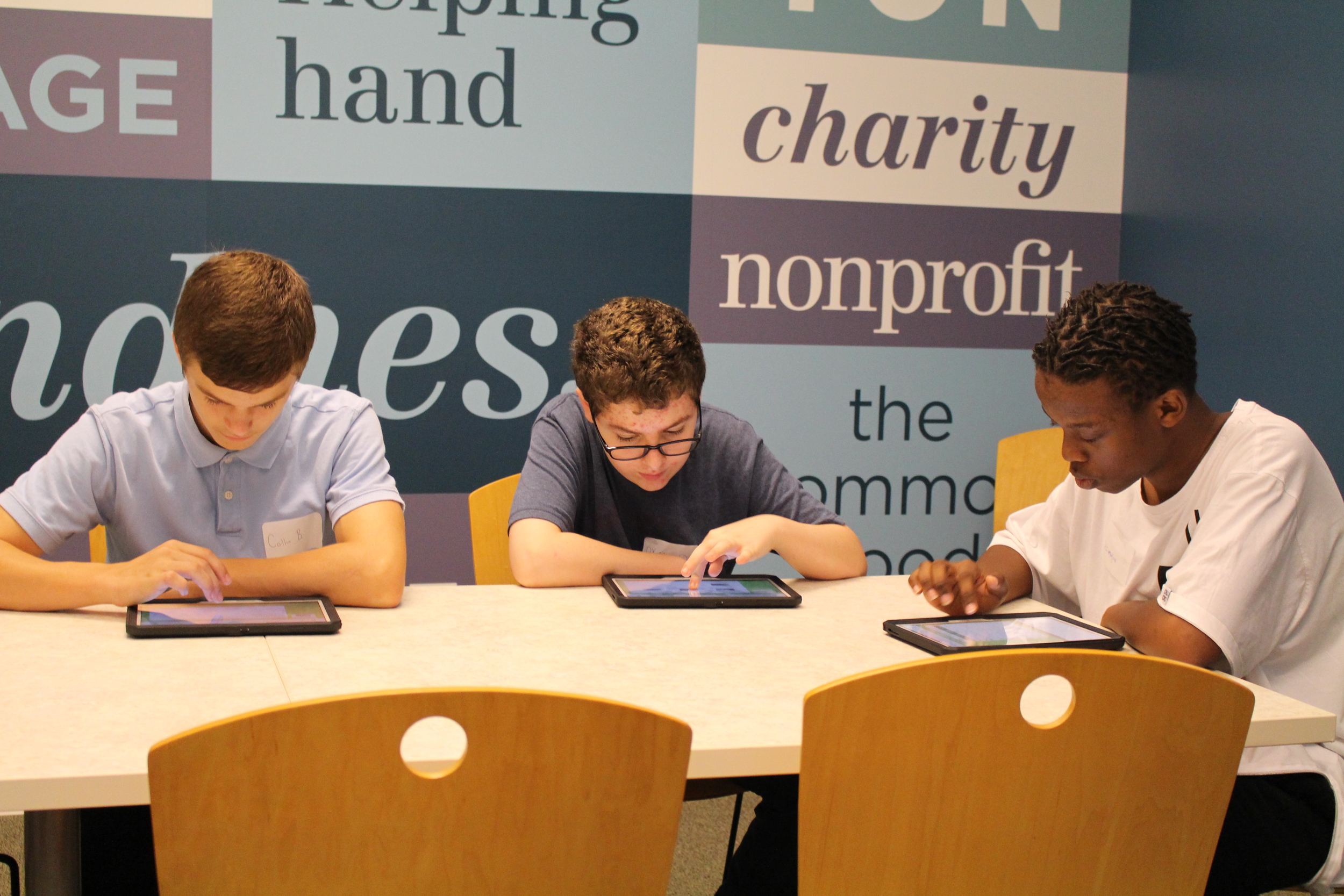

Image caption: Students on a field trip from Kettering Middle School

Two heavy doors at the front of the theater and a lowered projection screen block the kids from the mystery on the other side. It was what staff at the Junior Achievement Finance Park call the “big reveal,” which they assured would awe the 40 or so Prince George’s County eighth graders who sat in their theater seats with uncharacteristic silence.

“Everyone is going to get a new identity,” a teacher explains from a lectern beside the screen. “You might have kids, you might have a spouse. You’re going to have a job to pay your bills.”

The students were on a field trip from Kettering Middle School in Upper Marlboro, Maryland, to visit the new finance park run by Junior Achievement, an organization that, in part, helps kids understand money management. The students sat in the theater seats in blue uniforms. Among them was Prince Boyd, 14, a bright but shy kid. In real life, Prince dreams of becoming a marine biologist, but for today’s purposes, all he wants is a sports car.

Since the recession, our country has begun to acknowledge that it has a financial-illiteracy crisis. A 2009 National Financial Capability survey found that America’s understanding of money management, financial planning habits, and financial decision-making was “troubling.” And though it’s an acknowledged problem, only 19 states require schools to offer a personal financial course.

In a 2015 study by Champlain College that rated high school students in all 50 states on their financial understanding, more than half came in at a “C” or below, and even some states that earned a “B” required only 15 hours or less of instruction. Only five states (Utah, Georgia, Tennessee, Missouri, and Virginia) scored an “A;” all of those states require personal finance courses.

It is a subject that parents often don’t discuss with their kids. In fact, a survey by the financial-planning service Charles Schwab found that parents talk about money management to their children as infrequently as they talk about dating and sex.

This is why Ed Grenier, the CEO of Junior Achievement of Greater Washington, says it’s his goal “to reach every eighth grader” in the area. It’s a crucial time, he says, because that’s “when spending habits start.”

There are 18 finance parks in the country, and this location in Prince George’s County, which opened in October, is the second in the greater Washington, D.C. area. After in-class study sessions on credit, interest rates, and budgeting, some 9,000 eighth graders in the county are expected to visit this new, 13,500-square-foot building each year.

On the outside, the finance park is a modern building that looks like a giant shipping container. On the inside, it’s a theme park where each student receives an electronic tablet, and on that tablet is a randomly selected profile, like an avatar in a digital game of life. Prince completed a 92-page workbook that covered subjects like how to file a 1040-EZ tax form, and how to prepare for life’s emergencies—“Friend is hurt in your home. You need: homeowners insurance.” For Prince, the finance park promised to offer some fun, out-of-class learning.

Anxious to learn his pretend future, Prince and the other students watch as the projection screen rises and the doors swing open. There is a quiet pause among the students. Then laughter.

In the other room is a bank of mock department stores. There’s a home realty office, a credit union, a car insurance shop, even a restaurant (though it serves no food).

A staffer hands Prince his tablet, covered in a protective rubber case, and that’s when he learns that he’s a landscape designer with $31,000 in school debt. He makes $46,500, and is a single parent with a 2-year-old son. He clicks on a menu and reads the added costs associated with child-rearing. With deadpan voice and sullen face, he says, “In real life, I’ve decided that I don’t want a kid.”

The students spend the next several hours working through a software program that asks them to divide their monthly salary into all the normal costs associated with adult life.

One of the best possible profiles is a 34-year-old financial manager who brings in $109,000 a year, is single, and has no children. On the opposite spectrum is a married receptionist with one child who earns $29,000. The students use these profiles to make budgetary decisions. What type of car can they afford? Should they rent an apartment near the city or buy a mansion in the suburbs? Can they furnish it with plush furniture and flat-screen TVs? At the end of the day, the students will need to have planned a sustainable budget.

“What happens is what you would expect,” Grenier says. “They go to buy a house and they buy one they can’t afford. They go to the grocery store and buy all the expensive stuff.”

In each “store,” the students hold their tablets to a computer to learn what they’ll need to budget. As he leaves the electricity and utilities section, Chidera Nnawuba, 14, catches on quickly. He is a bus driver who makes $38,000 a year and he’s bought the least expensive apartment, has spent as little as possible on life’s frivolities, like NFL tickets, and wonders aloud if he could survive without a car. “I don’t really like being a bus driver,” he says.

This type of training has proven to help students. A 2015 study by the Financial Industry Regulatory Authority looked at Idaho, Texas, and Georgia—states with low, moderate, and high intensity finance programs, but all of which require one—and found that students who took the course saw improvements in their credit scores and were less likely to become delinquent on future credit payments. In its own pre-/post-tests, Junior Achievement has found positive increases in financial literacy, gains which it qualifies as “moderate to large.”

“A lightbulb comes on when they understand that these are the choices their parents make every day,” says Leanne Posko, senior manager of community affairs for Capital One, which invested $3 million in the new park. “It’s about making them uncover these decisions.”

Not all kids have their lightbulb moment. At a desk inside the station where students bought their pretend homes, the kid sitting across from Prince had budgeted all his extra money for trips to the movies and sporting events. Now he can’t afford furniture or a bed.

A teacher overhears this and says he needs to reconfigure his budget. “You have a family,” she says.

“Why can’t they sleep on the floor?” he asks.

Prince scrolls through his list of expenses. He’d bought a three-bedroom house in the suburbs instead of a modern downtown apartment (like he wanted). He sacrificed the name-brand clothing option so he could buy his son a zoo pass. “I want him to be interested in animals,” he says. “I remember when I was a kid, my dad took me to the zoo.”

As for the sports car, Prince compromised. He bought a 2006 Infiniti.

Source: https://www.nationaljournal.com/next-america/economic-empowerment/finance-park-play-raises-financial-literacy/?mref=landing-list